|

| Fees may be going up on the three public golf courses the City of Garland operates at Firewheel. |

Sprinkled liberally throughout these hearings is talk of fee increases or rate increases to citizens.

Separately, each of the proposed fee or rate increases doesn't seem like that much. Some apply to the average citizen, while others would be incurred only by builders or businesses, which most likely would pass them along to consumers. Collectively, however, it represents a common thread.

For example, the Parks, Recreation, and Cultural Arts Department has proposed a $2 increase in its youth ID cards and a $5 hike for its ID cards for adults. Rentals for certain rooms and facilities may go up $10 in their hourly rates (for example, the Hollabaugh pavilion increases from $40 to $50 hourly that an individual or group may soon pay for its weekend rental rates).

The cost for fees Garland landlords pay are projected to increase 18 percent, from $55 to $65 yearly, for a single-family dwelling used as rental. Application cost for an occupancy permit is proposed to go up $500; application for a new or revised concept plan for a planned development is proposed to go up $1,000 plus $50 an acre; alcohol distance variances up $200; zoning change applications a $200 increase to $1,000, and zoning verification letters to go up $150.

Fees for new construction on a single-family home are projected to go up from $3.75 to $4.00 per $1,000 construction value and from $5 to $7 per $1,000 construction value on remodels, canopy installation, etc.

The Health Department wants to charge $2.50 more per animal to pick up deceased animals from vets (expected to generate $6,000 in new revenue) and $5 more per day for quarantining an animal suspected of having rabies (expected to generate $2,450 in new revenue).

Then at the Firewheel golf courses, greens fees for golfers on all three public courses are proposed to be $2 more in FY 19.

For example, the Parks, Recreation, and Cultural Arts Department has proposed a $2 increase in its youth ID cards and a $5 hike for its ID cards for adults. Rentals for certain rooms and facilities may go up $10 in their hourly rates (for example, the Hollabaugh pavilion increases from $40 to $50 hourly that an individual or group may soon pay for its weekend rental rates).

|

| To rent the Hollabaugh pavilion citizens may have to pay more per hour on weekends, according to a proposal for the city's FY 19 budget. |

Fees for new construction on a single-family home are projected to go up from $3.75 to $4.00 per $1,000 construction value and from $5 to $7 per $1,000 construction value on remodels, canopy installation, etc.

The Health Department wants to charge $2.50 more per animal to pick up deceased animals from vets (expected to generate $6,000 in new revenue) and $5 more per day for quarantining an animal suspected of having rabies (expected to generate $2,450 in new revenue).

Then at the Firewheel golf courses, greens fees for golfers on all three public courses are proposed to be $2 more in FY 19.

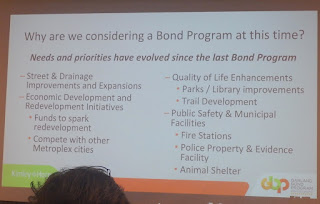

Add

this to the spectre of a tax hike that would occur if a proposed city bond

issue is passed. One councilmember says our council already has a "consensus" to raise taxes immediately as soon as the proposed bond election is approved by voters (presuming that it is).

The mayor, on the other hand, proposed a 1-cent tax reduction "on the debt side" but quickly acknowledged it may be short-lived, depending on the outcome of the proposed bond election.

If approved by voters and immediately funded by City Council, the increase in taxes would dramatically offset any short-term 1-cent reduction in taxes paid on the existing debt.

|

| A proposed bond program is being considered by Garland city council and citizens. |

The mayor, on the other hand, proposed a 1-cent tax reduction "on the debt side" but quickly acknowledged it may be short-lived, depending on the outcome of the proposed bond election.

If approved by voters and immediately funded by City Council, the increase in taxes would dramatically offset any short-term 1-cent reduction in taxes paid on the existing debt.

Not having spent some $100 million from its 2004 bonds approved by voters (nearly 50 percent of the original total), there's always the possibility our City Council will decide to finally spend those funds, too, again possibly raising your taxes to pay for it. Some council members say some of the proposals in the new proposed package will be additions to previous bonds approved—to pay for the increases in the original estimates, which would automatically put the original 2004 bond money into play. That could mean the public will be asked to vote on a $350 million bond package (or whatever they decide on), which in reality could be a $450 million package, if the full $100 million currently sitting on ice is put back into play.

This is not to say that some of the current proposed ideas for the possible bond election are not worthy. Many are needed and some absolutely necessary. But taken as a whole, due to the long delays, the total bill may be eye-popping for the people having to pick up the tab through their taxes.

Then there's the DCAD property tax increases headed our way. Some properties in our own neighborhood are up nearly an eye-popping 80% to 100%. How about yours? If you haven't received hefty property value increases yet, keep your eyes and ears open. They are coming, if not this year then the next. Because of state laws, the city, county, and school district may not be able to tax you at the full amounts of your new appraisal THIS YEAR or next year. They just have to phase them over time.

This is not to say that some of the current proposed ideas for the possible bond election are not worthy. Many are needed and some absolutely necessary. But taken as a whole, due to the long delays, the total bill may be eye-popping for the people having to pick up the tab through their taxes.

Then there's the DCAD property tax increases headed our way. Some properties in our own neighborhood are up nearly an eye-popping 80% to 100%. How about yours? If you haven't received hefty property value increases yet, keep your eyes and ears open. They are coming, if not this year then the next. Because of state laws, the city, county, and school district may not be able to tax you at the full amounts of your new appraisal THIS YEAR or next year. They just have to phase them over time.

And just when you think all the bad news

has been unpacked and on the table, officials from Garland Power & Light sent up a trial balloon warning that if current conditions continue, citizens could

see a hike in their electric rates within five to 10 years to bolster its reserve fund needed to maintain its top marks by rating agencies. GP&L officials did tell Council not to count on the large "contributions" our utility company was presumed to be making to the city's operating budget this year and next. At least they promised to make some contributions and especially not to ask the city for money for the city-owned utility.

And the city's water department reported that price of our water will go up another 5% (down from 10% initially suggested) despite conservation measures most of us have implemented. The North Texas Municipal Water District, of which Garland is a member, is the driver for the water increases, which is a very complicated financial/political situation. This is happening despite the fact that Garland was described as having been a "poster child" for water conservation, reducing overall usage from 11,000 gallons of water per month in 2006 to 6,400 gallons per month in 2017. Instead of rewarding citizens for cutting their usage almost in half, citizens get slapped with a rate hike (even though it's lower than originally predicted).

Citizens, beware! It's your money they're after.

And City Council budget hearings and discussions can be as confusing as budget hearings in the U.S. Congress. What's most important is to see where council lands at the end, especially if concerned citizens step in raising questions about specifics or too many rate, fee, and tax increases. Texas laws and the city's charter require processes that must be followed.

And City Council budget hearings and discussions can be as confusing as budget hearings in the U.S. Congress. What's most important is to see where council lands at the end, especially if concerned citizens step in raising questions about specifics or too many rate, fee, and tax increases. Texas laws and the city's charter require processes that must be followed.

Let me hasten to add that I've said for years that I would gladly temporarily pay higher property taxes to help improve our city's miserable streets because I like many others are already spending that much on damaged tires and front-end alignments due to the pot-holes and other street problems. For nearly a half-decade Council balked at allowing a voter-approved 2-cent temporary tax increase for our streets. Instead, Council "found" the money elsewhere—by not approving funds for other pressing needs such as more police and a bigger development office and thrust, which we sorely also need.

What complicates the situation is the failure for 14 years to use the roughly $100 million—nearly one-half—of the 2004 voter-approved bond package. Why? The publicly stated excuse is that we've been struggling to overcome the 2007 Great Recession. That's odd since most economists cite the Great Recession as having ended in June 2009. After that cities that also had put their bond sales and budgets on hold started turning loose of the money to restore infrastructure and meet other needs. For some reason, Garland didn't follow suit. Our political leaders love to point fingers of blame, but the bottom line is the whole gaggle of them in office over the past decade bear some responsibility for the delays.

Some cities have leap-frogged ahead of us—fixing their streets and other infrastructure needs. With the U.S. economy now roaring with so many restraints removed nationally, these places are prepared for a future filled with inflation and the eventual downturn that always follows a blazing boom.

Now, instead, our city's needs have stacked up higher than most realize. At the same time our city debt is fast approaching—in 2024—a payoff. We stand at an unusual crossroads, somewhat like the United States did for a brief few years at the end of the 1990s when our National Debt was actually shrinking.

Some cities have leap-frogged ahead of us—fixing their streets and other infrastructure needs. With the U.S. economy now roaring with so many restraints removed nationally, these places are prepared for a future filled with inflation and the eventual downturn that always follows a blazing boom.

Now, instead, our city's needs have stacked up higher than most realize. At the same time our city debt is fast approaching—in 2024—a payoff. We stand at an unusual crossroads, somewhat like the United States did for a brief few years at the end of the 1990s when our National Debt was actually shrinking.

|

| Fees to reserve classrooms and multipurpose rooms at Garland parks facilities may be hiked if a current proposal is passed. |

As I said earlier, I know city budgets are boring stuff—also lengthy and at points confusing.

The four public bond "hearings" were touted as tremendous successes because of the turnout of 134—many of them repeats and part of the reigning city insiders including city employees and elected officials—in a city of 240,000 people.

At the second "bond hearing", a Garland politico leaned over to me and commented about how many present were not "ordinary" citizens. He estimated "maybe a dozen" in the audience were just regular people. After he pointed out who he thought weren't insiders, I was able to point out the roles in city politics that about half of the 12 currently play, albeit in lower levels.

At the second "bond hearing", a Garland politico leaned over to me and commented about how many present were not "ordinary" citizens. He estimated "maybe a dozen" in the audience were just regular people. After he pointed out who he thought weren't insiders, I was able to point out the roles in city politics that about half of the 12 currently play, albeit in lower levels.

And few citizens have shown up for the first FY19 budget hearings.

None of the fee, rate, tax increases have been voted into law yet. The process is merely under way.

So, stay tuned and listen carefully during the next weeks and months.

But IF YOU DON'T pay attention to what is happening now, don't be surprised when city leaders turn a deaf ear to your complaints about higher rates, fees, and taxes after you are hit with them.

But IF YOU DON'T pay attention to what is happening now, don't be surprised when city leaders turn a deaf ear to your complaints about higher rates, fees, and taxes after you are hit with them.

Citizen apathy is at an all-time high, while our city stands at this pivotal moment and crossroads. Whither Garland? Don't let only a few citizens decide for you!

Citizens, let your voices be heard one way or the other on these matters!

Citizens, let your voices be heard one way or the other on these matters!